Gold, Growth, and the Fed Cut: Positioning for What’s Next

Rate cuts are here. Now’s the moment to think across gold, tech, and sectors still off the radar.

The Fed just delivered a 25 bps rate cut—and promised more to come. Markets cheered, but under the hood, this is a signal that conditions are shifting.

Inflation is cooling—but not gone. Employment is softening. And the Fed is navigating a slow pivot. That setup is historically powerful for assets sensitive to both liquidity and future growth.

This Gold Miner's Next Move Could Be a Game-Changer

A small-cap Nevada gold miner is already producing and has expansion in sight-backed by an onsite refinery and a $6 billion gold asset it's just starting to tap.

But that's not all.

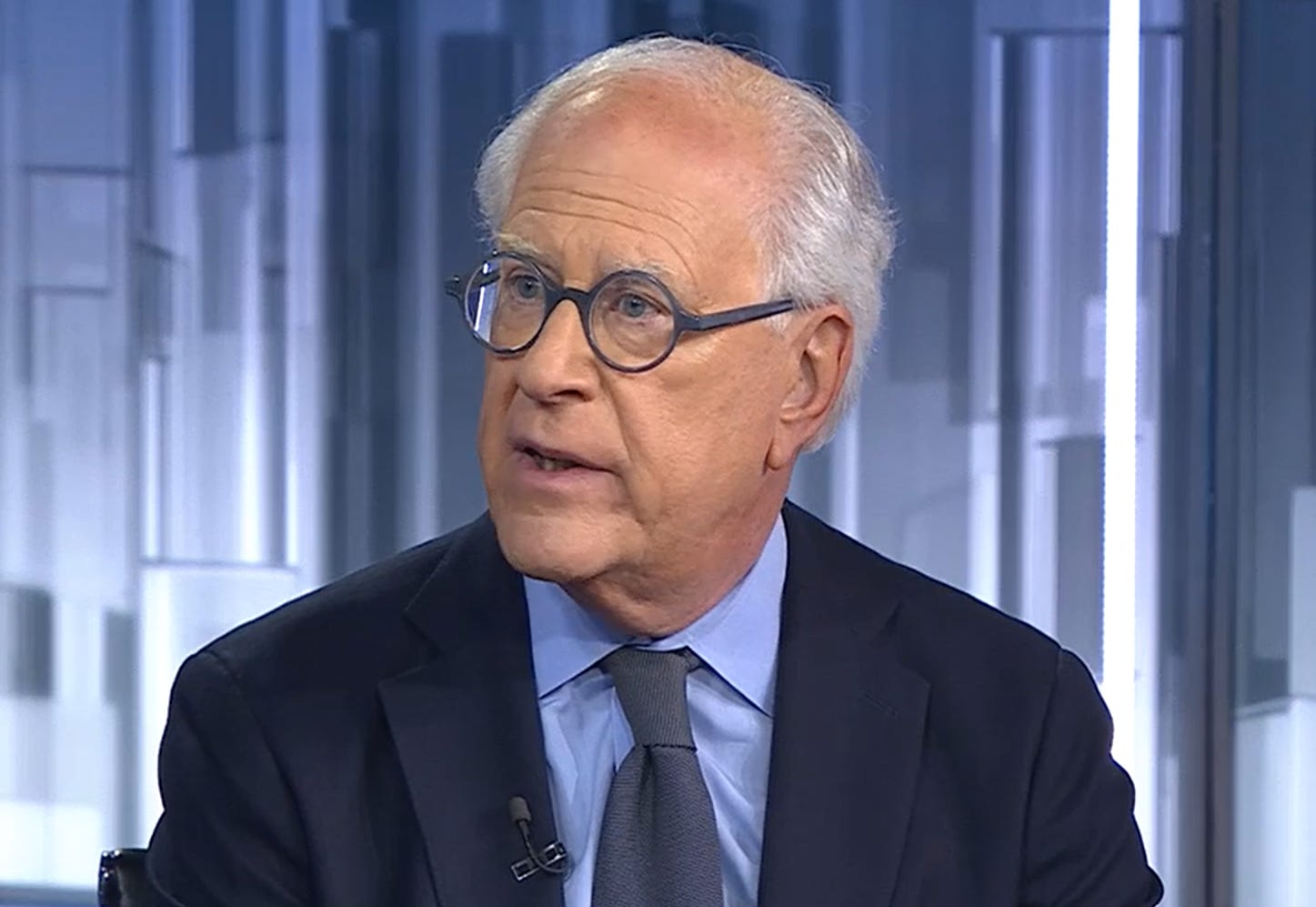

One of gold's most legendary investors recently doubled his stake in the company.

He's not alone.

And if the expansion hits, this could be the moment retail investors wish they had watched more closely.

Find out what's behind the growing buzz.

Where that may lead:

Gold’s Macro Tailwind: Gold tends to shine when real rates fall faster than nominal ones. That may be underway. With inflation still near 3%, any dollar softness or rate slide could create upside for physical gold—and gold stocks.

Tech’s Second Wave: Nvidia’s $5B investment in Intel isn’t just a vote for chips—it’s a vote for AI infrastructure scale. That puts packaging, power efficiency, memory, and legacy chipmakers back into play.

The Mid-Cap Opportunity Zone: Small and mid-sized companies—especially in tech and industrials—may benefit from lower borrowing costs and revaluations. Look for companies with high debt but improving margins.

Fixed Income Reset: Rate cuts reprice bonds. If the market believes the Fed is truly on a cutting path, longer duration bonds or high-grade credit may move early.

Commodities with Leverage: Oil is off today—but if demand picks up and the Fed eases further, we may see a rerating across metals, energy, and agricultural inputs.

Final Word: Big moves often start quietly. The Fed’s cut didn’t just trigger a rally—it started a new cycle. Find what hasn’t moved yet, and ask what might have to.

BULLISH: It's time to buy this 'hidden' AI stock

An award-winning stock-rating system has turned BULLISH on some of the biggest winners of 2025. Here's what it's saying now.